Paystubs are legal documents often used by employers to provide employees with detailed information on their earnings, taxes, and deductions. However, paystubs are not limited to employees. A self-employed individual such as a small business owner or independent contractor can also generate paystubs for themselves using online tools and enjoy the benefits of having one.

We’ll go cover everything about paystubs in this article, including benefits and how to replace lost paycheck stubs. Before we dive in too deep, let’s first understand what is included in a paystub.

What’s on a paystub?

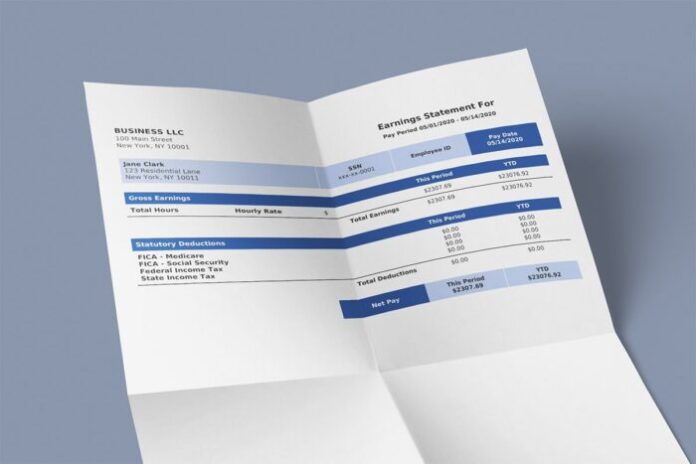

A pay stub usually includes salary information along with taxes paid. In other words, the document will show the gross wage, net pay, federal and state taxes withheld, deductions, or contributions for the employee to see.

A pay stub will also include information for both the employee and employer, such as names and addresses.

What should you do if you lose your paystubs?

According to experts, it is advisable to hold onto your paystubs for at least one year or until you receive your annual Form W-2. Doing this helps you confirm that the information contained in the financial document matches that on your W-2 form.

However, it is not unusual to lose or misplace your paystubs before the end of this period, but you don’t have to panic if that happens. As long as you have a bank statement to prove payments received, you can use an online check stub maker like thepaystubs.com to replace your lost or misplaced paycheck stubs.

Be sure to have the document signed by your employer if you plan to use it for legal purposes.

Seven main reasons why paystubs are essential

1. They act as proof of income

At some point, as an employee or an independent contractor, you will need to prove your income. This is often true when trying to access a personal loan, purchase a vehicle through financing, or rent a new place.

In such instances, especially if a significant amount of credit is involved, the businesses you are dealing with will require that you provide proof of income to ascertain that you can meet your financial obligations. In most cases, a paycheck stub will serve as enough proof of income.

2. State requirement

There are no federal laws requiring employers to provide employees with paystubs. However, every state has its own regulations concerning payroll. There are three different requirements for businesses regarding paystubs depending on the state: access states, access/print states, and no requirement states.

In access states, employers have a legal obligation to provide employees with pay stubs in whatever format, printed or electronic. In access/print states, paystubs can be issued to employees either in printed or electronic form; however, they must be easily printable if you choose the electronic route. No requirements states do not require an employer to issue employees with paystubs.

3. They help with the tax filing process

The information displayed on the paystubs includes all federal and state taxes withheld from you by your employer. That means you can easily use a pay stub to keep track of your taxes and ensure that you are not paying less than expected, which could result in backed-up taxes during the tax period.

Additionally, holding on to your paystubs until the end of the financial year can help reconcile the numbers on your form W-2 with those on your paystubs to ensure that they align and that you are safe.

4. If you suspect inaccurate payment

Paycheck stubs often indicate the gross income, hours worked, including overtime, statutory deductions, and any other deduction necessary. However, sometimes payroll mistakes can happen. If you think your employer made an error in calculating the hour worked, or the deductions, your paystub could help prove your case and have corrections done.

5. Paystubs can be a morale booster

Every employer knows that employees’ morale can have a very significant effect on their productivity. The good news is that providing your employees with pay stubs at the end of every pay period can help boost their morale.

That’s perhaps because a paystub gives workers a clear understanding of how long they worked and the amount of money they made in a given pay period. That kind of transparency and accountability is the reason your employee will stay motivated because they are certain to take home what they rightfully deserve, even for extra hours worked.

6. Paystubs can help you stay organized

Paystubs are not only a preserve of established businesses. Instead, they can be used in virtually any company, big or small, to ensure the payroll stays organized. Even as an independent contractor, generating your paystubs can be an excellent way of helping you keep good track of your finances.

In other words, a pay stub will help you track your growth or lack of it, so you make necessary adjustments. As an independent contractor, you will also realize that staying organized can be challenging as you grow and start working with staff or subcontractors. Fortunately, generating pay stubs can be an excellent way to keep things organized.

7. Keep track of your expenses

Paying your employees is an expensive affair, and you should keep good track of it. While you may have other means of tracking your employees’ payments, paystubs provide a layer of security and maybe the only way of correcting discrepancies when they occur.

If, for instance, you notice an unexplainable increase in your expenses, the first course of action should be reviewing all your expenses, including your payroll expenses. If your payroll expenses don’t add up, looking at your employees’ paystubs can help you establish if some employees may have received bonuses that were not recorded elsewhere.

Final words

Clearly, pay stubs provide a host of benefits for employees and self-employed individuals. Whether you are an independent contractor or employed, you have every reason to obtain or generate an itemized pay stub for every project or pay period worked.