Bitcoin, the world’s first decentralized digital currency, has taken the financial world by storm since its inception in 2009. As the popularity and adoption of this asset have grown exponentially, so have the fortunes amassed by early adopters, institutional giants, and even celebrities.

Satoshi Nakamoto’s Mystery: Uncovering the Founder’s Bitcoin Holdings

One of the greatest mysteries in the realm of Bitcoin is the identity and holdings of its enigmatic creator, Satoshi Nakamoto. Despite being credited with inventing the blockchain technology that underlies Bitcoin, Nakamoto’s true identity remains unknown. Estimates suggest that Nakamoto’s Bitcoin holdings could be worth billions, but the exact amount and the whereabouts of these coins remain shrouded in secrecy.

Institutional Giants: Exploring the Largest Bitcoin Holdings

In recent years, institutional giants have recognized the potential of Bitcoin and have amassed substantial holdings. Companies like MicroStrategy, Tesla, and Square have made headlines with their significant investments in Bitcoin. MicroStrategy, led by CEO Michael Saylor, has been particularly notable, converting a significant portion of its cash reserves into Bitcoin.

These institutional players not only contribute to the upward price movement but also lend credibility to the cryptocurrency. Their involvement in Bitcoin signifies a growing acceptance of digital assets as a legitimate store of value and an alternative investment class. The scale of their holdings and the long-term strategies they adopt are closely watched by investors and industry observers alike that use trading platforms like https://bitalpha-ai.io/

Fortune from Early Adoption: Examining the Wealthiest Investors

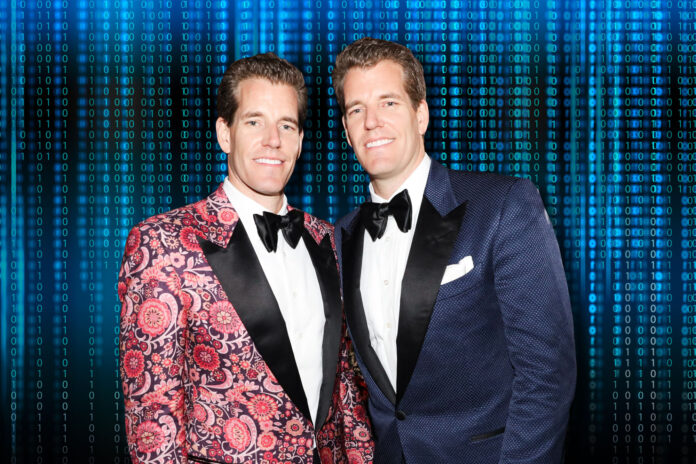

Bitcoin’s early days saw visionary individuals who recognized its potential and acquired substantial amounts at a fraction of the current prices. These early adopters, often referred to as ” millionaires” or ” billionaires,” have accumulated immense wealth. Notable examples include the Winklevoss twins, Roger Ver, and Barry Silbert.

The success stories of these early adopters serve as a testament to the transformative power of Bitcoin. Their foresight and conviction in the potential of a decentralized digital currency have rewarded them handsomely. However, their journeys have also been marked by challenges and volatility, as they navigated through the nascent and unpredictable cryptocurrency market.

Bitcoin Whales: Analyzing the Impact of Large-Scale Holdings

Bitcoin whales are individuals or entities that possess a significant number of these assets. These massive holdings can exert influence on the market, as their buying or selling decisions can cause price fluctuations. The behavior of whales is a subject of great interest and speculation in the cryptocurrency community.

Some argue that they manipulate the market to their advantage, using their vast holdings to initiate price movements that benefit their positions. Others contend that these whales simply exercise their rights as early adopters or long-term investors and have no malicious intent.

Public Figures: Revealing Celebrity Crypto Ownership

Cryptocurrency ownership is not limited to tech enthusiasts and financial institutions. Many celebrities have also embraced Bitcoin and other cryptocurrencies. Personalities like Elon Musk, Snoop Dogg, and Gwyneth Paltrow have publicly expressed their interest in Bitcoin or invested in crypto-related ventures.

The involvement of public figures in cryptocurrencies often brings increased attention and mainstream recognition to the space.

Their endorsements and public statements can influence public perception and attract new investors to this crypto. However, the influence of celebrity endorsements should be approached with caution, as it can also contribute to increased market volatility and speculation.

Government Institutions: Unveiling National Crypto Reserves

Governments worldwide have recognized the potential of cryptocurrencies and have started accumulating this coin as part of their national reserves. Countries like the United States, Germany, and Switzerland have either purchased or confiscated substantial amounts of Bitcoin. This move signifies a shift in the perception of cryptocurrencies from being a fringe technology to a recognized asset class.

The motivations behind government acquisitions of Bitcoin vary. Some view it as a hedge against economic uncertainties, while others see it as a strategic move to diversify their holdings and gain exposure to a digital asset with potential long-term value. The accumulation of this asset by government institutions adds legitimacy to the cryptocurrency ecosystem and further blurs the lines between traditional finance and the digital world.

Hacks and Scandals: Investigating Stolen Bitcoin and Lost Wallets

While Bitcoin provides robust security through its cryptographic protocols, it has not been immune to hacks and scams. Several high-profile incidents, such as the Mt. Gox and Bitfinex hacks, have resulted in the loss of millions of dollars worth of Bitcoin. These incidents highlight the importance of proper security measures and the need for constant vigilance in the crypto space.

The recovery of stolen coins and the prevention of future hacks are ongoing challenges for the cryptocurrency community. Efforts are being made to improve security infrastructure, implement multi-signature wallets, and enhance user education on best practices for securing their digital assets. The lessons learned from these security breaches are valuable in strengthening the overall security of the Bitcoin ecosystem.

Wall Street: Insights into Hedge Funds and Investment Firms

Hedge funds and investment firms, such as Grayscale Investments and Fidelity, have launched Bitcoin investment products to cater to institutional and retail investors. This trend signifies the growing recognition of Bitcoin as a legitimate investment asset within the established financial industry.

The involvement of Wall Street in Bitcoin brings increased liquidity, market stability, and professional expertise to the cryptocurrency market. Institutional investment in this asset is seen by many as a positive development that could lead to greater adoption and integration of cryptocurrencies into the traditional financial system. However, it also introduces new dynamics and regulatory considerations that need to be addressed as the market matures.

Beyond the Numbers

Beyond the immense wealth accumulated through Bitcoin ownership, there are broader socioeconomic implications to consider. Its decentralized nature challenges traditional financial systems and opens up opportunities for financial inclusion and empowerment. Its borderless and permissionless nature allows individuals to transact directly, without the need for intermediaries.

This coin has the potential to revolutionize remittances, banking services, and access to financial tools for the unbanked and underbanked populations. It offers an alternative store of value for individuals living in countries with unstable economies or facing hyperinflation. However, challenges such as scalability, regulatory frameworks, and energy consumption need to be addressed to fully unlock the socioeconomic potential of Bitcoin.

Conclusion

Bitcoin’s ownership landscape is a diverse and fascinating one, with new trends continuing to emerge. With the right information, you can better understand who owns this asset, how they own it, and what those holdings mean for the future of cryptocurrency. By understanding these insights into the biggest crypto holdings, you can make more informed decisions about your own investments in crypto and other digital assets.