Remember the days when purchasing a car was as simple as going to a car dealership for a test drive and then instantly signing the paperwork to get the car’s ownership. I am afraid those days are long gone, as the car buying process has only got more complicated since the onset of the COVID-19 pandemic. With negligible availability of new cars since the pandemic, the average customer has to explore new paths to obtain the car of his dreams. This is where websites like CarIndigo have had a lot of buyers find the ideal car for themselves.

However, for people who want to know how, and why, the global supply chain has been impacted during the pandemic, here are some excerpts from a real-life experience of a car buyer.

Chase Weldon, an avid SUV enthusiast from Colorado, spent a substantial amount of time researching all the SUVs available on the market. When he finally came to a proper conclusion after weeks of gruesome research, he approached his nearest car dealership to purchase his favorite SUV. Little did he know that he would spend more time in his attempt to buy an SUV than all the time he had spent researching.

He was quoted as saying, “I was working with some dealerships across the country. I reached out to probably 30 dealerships. … Of those 30, half got back to me.” Most salesmen that reached out to him had already offered his preferred SUV to some other customer or refused to offer him a bargainable value. These were surely testing times for the car enthusiast who exclaimed that it was a totally different car-buying experience for him this time around.

The outbreak last year led to numerous factory shutdowns last spring. This resulted in a global shortage of semiconductor chips, which is an essential component of automobiles. The new vehicle inventory in the US has seen an inevitable scarcity, as shoppers face the ordeal of waiting weeks or even months for their favorite automobile. However, for automakers and sellers, this scarcity could contribute to greater earnings in the long run and also better promotion for new vehicles before they arrive at the dealerships.

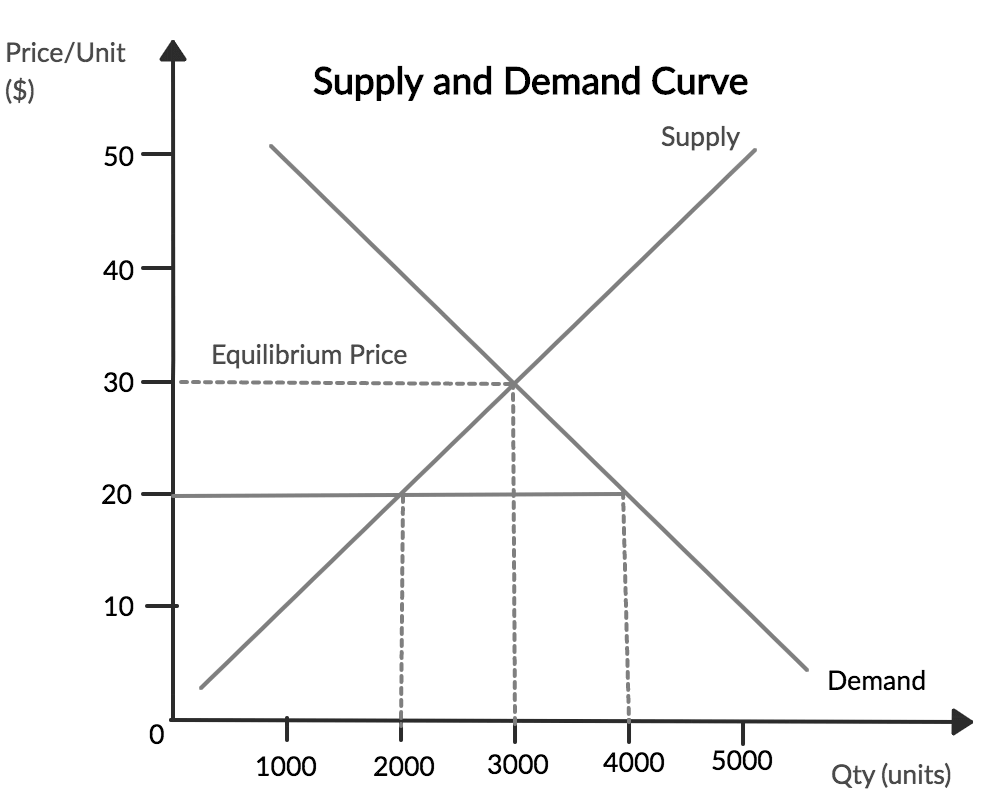

Demand vs Supply: How the gap is widening between these two

Michelle Krebs, executive analyst at Cox Automotive predicted that the sales pace will get faster than the resupply rate, and things will only get tighter moving forward. Automobile supplies might be in a tight spot throughout 2025. The demand is only getting higher, as automakers are encountering a strong surge in consumer demand since the onset of the pandemic. Thus, automakers are still selling in huge numbers despite the shortage in their inventories.

Cox Automotive says that the days of supply of new vehicles across the US are currently at 47 and are slowly approaching the low-30s mark. For some pickups and SUVs, the situation is even worse with days of supply now in single digits. This is comparable to the historical days of supply of at least 60. This figure is higher for easily configurable vehicles like pickups.

Mike Bowsher, a car dealer from Georgia claimed that automotive stocks at his 4 General Motors stores were only 20% of the typical value. He also said, “We’re selling it way up into the pipeline. When a truckload shows up, 75% of the truck is already sold.” Bowsher is also the head of Chevrolet’s nationwide vendor council. He said that he would appreciate extra pickups from the automaker. But he also exclaimed that the current selling period had the most margin for profits in all his years of experience.

Sonic Automotive President Jeff Dyke also made a statement to CNBC, that everyone involved with the industry is going to end up with a lot of bucks from here on out. We also aren’t likely to see the situation revert to pre-Covid levels. Publicly traded dealers like Sonic and AutoNation took advantage of this whole change in the ballgame. These sellers reported record profits in the first quarter itself. Dealers are earning more money by holding out their inventories on low levels and selling them to buyers at higher average prices.

AutoNation CEO Mike Jackson recently admitted to investors that supply is outpacing demand in the automotive sector. He also adjusted the pricing of his automobiles to meet the high demand, thus resulting in substantial front-end growth for his dealerships.

How long will this phenomenon last?

Automakers are traditionally known to thin their inventories on purpose in order to boost their profits to high margins. However, this is easier said than done, as automakers face constant pressure from other competitors when it comes to attracting customers.

With discounts and incentives to sweeten up the deal, automakers sell their cars in huge numbers. A proper balance between supply and demand is vital, as there is always a substantial amount of customers and dealers pleading for their favorite SUVs and truck models to be on sale.

Contracts have been signed between the Detroit automakers and the United Auto Workers for more flexibility in automotive production. But resting tens of thousands of workers off the automotive plants could prove detrimental. On the other hand, if the workers are retained, plants would still take weeks to restart after a shutdown.

On this matter, Ford CEO Jim Marley spoke to investors that his company will run leaner inventories in the near future following a record pretax operating profit. His company also surpassed all Wall Street expectations, thus leading to this decision. “I want to make it extremely clear to everyone. We are going to run our business with a lower days’ supply than we have had in the recent past because that’s good for our company and good for customers,” he was quoted as saying.

Not all customers are reeling under the burden of the limited supply period. This time has proved to be extremely fruitful for owners who are willing to trade in a car, as dealers are reportedly offering higher prices. Used car prices are on an upward trajectory right now, as many customers are willing to settle in for a used car owing to the lack of inventory supply and higher prices.

As a matter of fact, this is what our real-life car buyer from Colorado ended up doing. Mr. Weldon built a connection with a nearby dealership and ended up driving home with a used 2018 Toyota Sequoia SUV. He finally got his desired automobile by nose-diving deep into the subject. By establishing a great bond with the dealer, he ended up finding the exact car that met his requirements and having a final say in what he craved. We hope other car shoppers also perform some adequate research of the market before making their move.