Navigating the financial markets, whether as a novice or an expert, can seem overwhelming and complex. The vast array of trading instruments, platforms, and strategies can leave one feeling bewildered. But worry not!

This comprehensive guide aims to demystify the trading world and provide a roadmap for individuals interested in embarking on this thrilling adventure.

Whether you’re intrigued by stocks, foreign exchange (Forex), cryptocurrencies, or other investment opportunities, this article covers the essential tools, tactics, and insights to help you start with confidence.

Exploring the World of Forex

Forex, or foreign exchange, trading involves the buying and selling of currencies. It’s a market known for its liquidity and operates 24 hours a day, providing flexibility for traders around the globe.

Start with major currency pairs like EUR/USD or GBP/USD, as they tend to have more available information and analysis.

Since Forex trading involves pairs of currencies, understanding the economic factors that influence each currency is crucial. Interest rates, inflation, political stability, and other macroeconomic indicators play a significant role.

Balancing technical and fundamental analysis, as well as implementing sound risk management strategies will help you navigate the unique dynamics of the Forex market.

Choosing the Right Platform

Selecting a suitable platform is the linchpin of a successful trading journey. These digital venues are where financial transactions take place, and they vary significantly in terms of fees, ease of use, customer support, and available features.

Consideration of your trading style, goals, and budget is crucial in selecting the right platform that fits your needs. Research and review platforms, and don’t be afraid to take advantage of trial periods or demo accounts to get a hands-on feel of the experience.

Equally vital is assessing the security and reliability of a platform. Ensure that the platform complies with the regulations of the financial authorities in your jurisdiction.

Look for transparent information about the security measures in place and reviews from other users. The right platform should provide both stability and safety, offering the peace of mind needed to focus on what matters – making informed trading decisions.

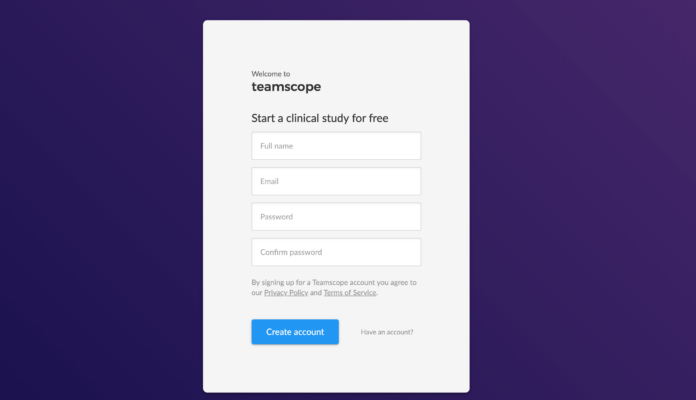

Setting Up Your Account

Once you’ve zeroed in on the right platform, the next step is establishing your trading account. This involves providing personal identification details and usually requires proof of identity and residence.

While this process might seem cumbersome, it’s part of the essential Know Your Customer (KYC) regulations that protect both the trader and the platform from fraudulent activities. Ensure that your documentation is in order, as this smoothens the account creation process.

Your trading account will be the gateway to all your investment activities, so customizing it to suit your needs is essential.

Select the trading instruments that interest you, set up alerts and notifications, and familiarize yourself with the layout and tools. Investing time in understanding the functionalities will pay off in smoother, more efficient trading.

Many platforms also offer tutorials and customer support to guide you in this initial phase.

Risk Management Strategies for Beginners

When it comes to investing, managing risk is paramount. As a beginner, understanding your risk tolerance is key.

Determine how much capital you’re willing to risk and consider setting stop-loss orders to limit potential losses. This way, even when trades don’t go as planned, you have measures in place to minimize the damage to your financial health.

Another angle of managing risk revolves around diversification. Instead of putting all your eggs in one basket, consider spreading your investments across different instruments or markets.

This approach helps mitigate the risk associated with fluctuations in a particular sector. By building a diversified portfolio, you not only protect your capital but also create opportunities to explore different markets and learn from various trading experiences.

Analyzing Market Trends and Signals

Understanding the dynamics of the market is essential for informed trading decisions. Engage in comprehensive research, keeping an eye on current news, economic indicators, political events, and other factors that might influence market trends.

Utilize charts, graphs, and analytical tools provided by your trading platform to track changes and identify potential opportunities or warning signs.

Technical analysis is another powerful tool for traders. By examining historical price data, you can identify patterns and trends that might predict future movements.

Paired with fundamental analysis, which looks at the overall health and performance of an asset or market, these techniques can provide valuable insights.

Balancing both forms of analysis enables you to develop a well-rounded perspective, enhancing your decision-making process.

Developing Your Trading Plan

Having a trading plan is like having a roadmap for your investment journey. Begin by clearly defining your financial goals, style, and the time you can dedicate to trading.

Are you looking for short-term gains, or are you investing for the long run? Understanding your preferences and constraints is the first step in creating an effective plan.

Once you’ve established a clear vision, outline the strategies you’ll employ, the instruments you’ll trade, and the risk management tactics you’ll adopt.

Regularly revisit and adjust your plan as you gain experience and as market conditions change. Remember, a trading plan is not set in stone; it’s a flexible guide that grows and evolves with you as a trader.

Stocks and Equities

The world of stocks and equities offers an accessible entry point for many traders. Starting with well-known companies or industries you understand can make the process more relatable and engaging.

Analyze companies’ performance, leadership, competition, and overall market trends to make informed decisions.

Meanwhile, trading in equities requires a keen understanding of market dynamics, economic indicators, and even geopolitical factors. The stock market can be volatile, so proper risk management and a clear trading plan are essential.

Engaging in both short-term and long-term investments can create a balanced portfolio that aligns with your risk tolerance and financial goals.

Getting Started with Cryptocurrency

The relatively new frontier of cryptocurrency trading is both exciting and enigmatic. Cryptocurrencies like Bitcoin and Ethereum have captured the imagination of traders and offer opportunities for both short-term speculation and long-term investment.

Start by understanding the technology, market sentiment, and factors that influence price movements in the crypto space.

Given the inherent volatility and regulatory uncertainty surrounding cryptocurrencies, caution must be exercised. A well-researched approach, coupled with strong risk management practices, is essential.

Utilize tools like demo accounts or paper trading to gain experience without risking actual capital. Remember, the crypto landscape is evolving rapidly, so staying informed and adaptable is key.

Final Thoughts

The enthralling world of trading doesn’t have to be a labyrinth of confusion and complexity.

By understanding the fundamental concepts, choosing the appropriate instruments, developing a sound plan, and committing to continuous learning, you can embark on a rewarding investment journey.

While risks and challenges are part and parcel of trading, the knowledge and strategies provided in this guide empower you to approach the markets with confidence and curiosity.

You can also read our article about the psychology of trading and how to stay focused and not lose money.