Financial analysts are predicting that this is the year of housing price retreats. You might think it doesn’t matter what the value of your house is, but how much money you have tied up in your home will seriously impact what you can borrow against it.

If your house is worth less than you have borrowed, it will be challenging to get a new mortgage. There are a few ways of going about checking what your home may be worth these days. You can do it on your own or hire someone to assess the value of your home for you.

Many factors influence the value of your house, especially your mortgage. The following are some of them:

Mortgage

The mortgage on your house is one of the most critical factors determining how much your house is worth. A reasonable mortgage rate and the loan amount will make your home more valuable than usual.

A lousy mortgage rate and the loan amount will find that your home is not as practical as it was previously thought to be before applying for such a loan. Your mortgage status is determined by your current loan’s interest rate and the time left until it expires.

Using moneywise.com to shop for the best mortgage rate you can find is a good idea. The longer you have to pay for your mortgage, the less valuable your property will be because fewer years are left to repay the loan. Getting the best mortgage rate is a great idea, but you should know it can also affect how much your house is worth.

The Condition of Your House

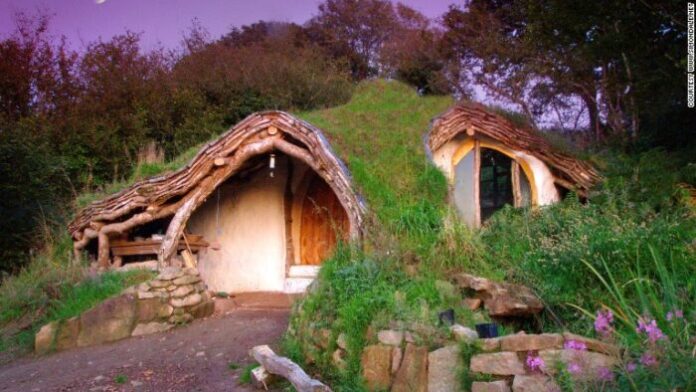

Your house’s value also depends on its condition; the better it looks, the more money you can easily borrow against it. The state of your house crucially determines how much your property is worth.

Your house is worth more if it has some valuable architectural elements. Ideally, your home should have decent rooms with high ceilings, quality fixtures, and fittings, wooden flooring, tiled floors, or marble tiles on the kitchen floor.

If you have a well-maintained garden, good paint, and the home’s interior looks well furnished, it will be easier to sell or borrow against such property than if your home is dirty and not appealing. Improving your home’s condition will help boost its value when you eventually put it on the market.

Season

The season where you place your home on the market also determines its value. It would be hard selling off summer homes in winter; it’s so much easier to sell or borrow against your house during spring or autumn.

Similarly, the time of the year when you buy is essential, too. If you believe a house in August, it may be worth less than what you have paid for it. The value of a home can drop as much as 10% from its original value during this time of the year.

You should also consider the competition when buying a home, primarily if that house is located in an area where many other properties are available for sale or rent.

Location

The location of your house affects its value too. The appreciation rate for specific areas is usually different from one place to another.

The home you own in the city center will likely be worth more than one located far away from the city center. The more accessible your house is, the better you can rent it out or borrow against it.

Property near good schools usually increases its value over time because parents prefer to buy homes where their children can get a quality education. Therefore, the value of your home is determined by how accessible it is and whether it has the basic amenities that are needed.

Current Economic State

The current state of the economy also affects how much you can get in return for your house when selling it. If the economy is doing poorly, then you will likely not get as much return on investment.

The house’s location depends on the economy where it is located, as areas that have a weak economy will be more affected.

The real estate market is greatly affected by the location and the current economic status of a country. The value of your house depends on how much other people are willing to pay for it, so you should try not to overprice it if there are only a few buyers in the market.

The Age of Your House

Another factor that determines how much your house is worth is its age. A newly constructed home will be worth more than an old one because the new home has not yet depreciated, unlike the older one, which may already have undergone depreciation over time.

The cost of replacing various components of an old house might be more than building a new one. Hence, it is easier to borrow against a newly built home because there is no need for any replacements in the future since it has not been used before.

The Number of Bedrooms

The number of bedrooms that your house has will also determine how much you can borrow against it. A large family is likely to own a home with more than two bedrooms.

They can easily borrow more because their homes are worth more than homes owned by people who only have one bedroom since the value of the first home is worth less than the latter.

The Number of Bathrooms

Having more bathrooms will also increase your home’s value. A house with more than one bathroom will sell faster than one with fewer bathrooms; this is because it is easier to find buyers for homes that have all the necessary amenities, including more than one bathroom. It is, therefore, logical to buy a house with as many bathrooms as possible.

How Much is Your Property Worth?

Having analyzed the factors that determine how much your home is worth, it might be challenging to determine the kind of mortgage you should go for because several other aspects will affect your eligibility and affordability.

You can get a clear answer by using mortgage comparison tools to determine the best mortgages for your current situation.

The advice offered by such online tools makes it easy to apply without any errors and delays because they guide you through the entire application process making sure that you complete all stages within a short time.