No matter how big or how small your company is, there will come a time when you will need to borrow money either to expand your business, to pay off debts, or simply to achieve your operational efficiency goals.

There are a plethora of options for your business, and you can get a loan for equipment, growth, and inventory or for any other purpose that you want. However, there are a few factors that affect your ability to get the loan and the amount of loan that you can get approved. One of these factors is your business credit score. It is the primary factor that affects the business loan that you ask.

What Is a Business Credit Score?

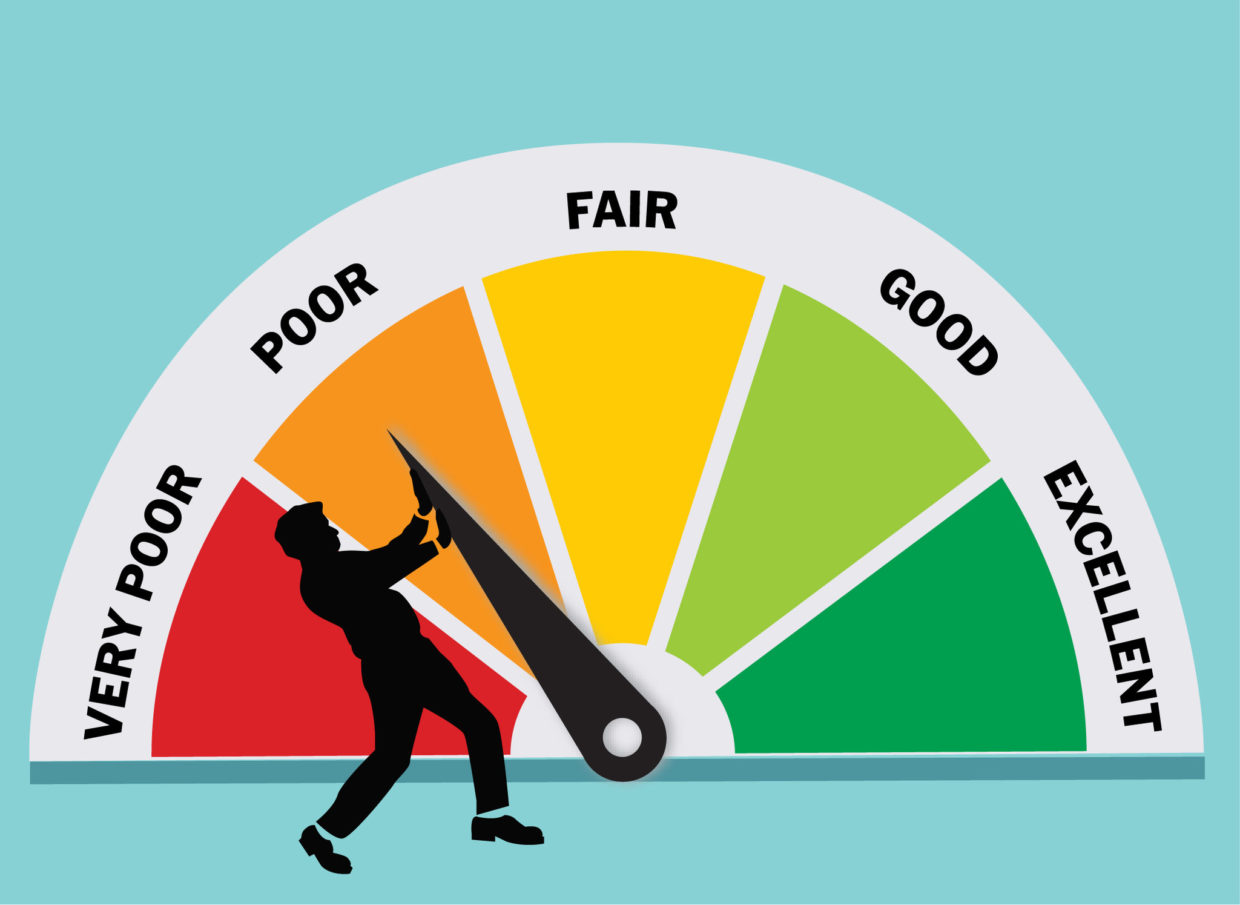

As a consumer, you have a consumer credit score that tells lenders how much you can be trusted as compared to others and how much credit you can handle. It is a number that is based upon all the data that is collected from your credit report.

Similarly, as a business owner, you also have a business credit score. Just like a consumer credit score, a business credit score is also based on your business’s credit report. Your score tells lenders how you manage your finances and what your business’s financial situation is. For example, if you approach a financial institution to obtain fastcapital360 for your business, they will first check your business credit score, among other things, before approving your loan.

Why Does Your Business Credit Score Matter?

If we speak about financial situations, then after your personal credit history, your business credit history is the most important thing. If you have a small business that generates less than a million dollars or a company that has a few employees, then your credit might come into play. But when you try to expand your business or increase your sales, then you will need financial help. That is when your business credit score comes into play. As a business owner, you know it can be hard to keep your business on a firm footing at all times. Without a good business credit score, you will be hard-pressed to conduct your business the way you want. Your business credit score will come into play when you work with your suppliers, banks, insurance companies, or other companies for providing services or acquiring any of their services. Many, if not all, of the business entities listed here will have a look at your business credit score before they choose to work with you. If you have a good score, you can avail many benefits like a low-interest rate or better business terms. But if your score is not that good or downright wrong, that may scare away the clients and the partners. They will vary when working with you; your loans might get denied, or they might move up the due dates for the payments. Insurance companies will also increase the premiums.

What Does a Business Credit Score Measure?

So what is it exactly that a business credit score tells others about your company? There are various criteria that businesses will use to evaluate your company for financial risks.

Following are some criteria to measure a business’s credit score:

- Credit History Age

- Public Records

- Existing loans

- Your business’s ratio of credit utilization

- Your business’s payment history

- The size of your company

- Industry risk

- Recently applied for loans and lines of credit

Ways of Improving Your Business Credit Score

Keeping a good credit score is vital for your business’s survival in tough times. There are several ways that you can do that.

1. Check Your Credit Report

The first thing that you need to do is to find out what your position is right now. You can approach any credit reporting company like Equifax, Experian, or any other and ask for your business credit report. You will have to pay some amount for these reports but don’t consider the money. If you don’t know what your credit score is, you may not be able to acquire a loan when you want or get enough money for your needs. Understanding your business credit report is the first and foremost step in improving your score. Once you know where you stand, you can work on it to make it better.

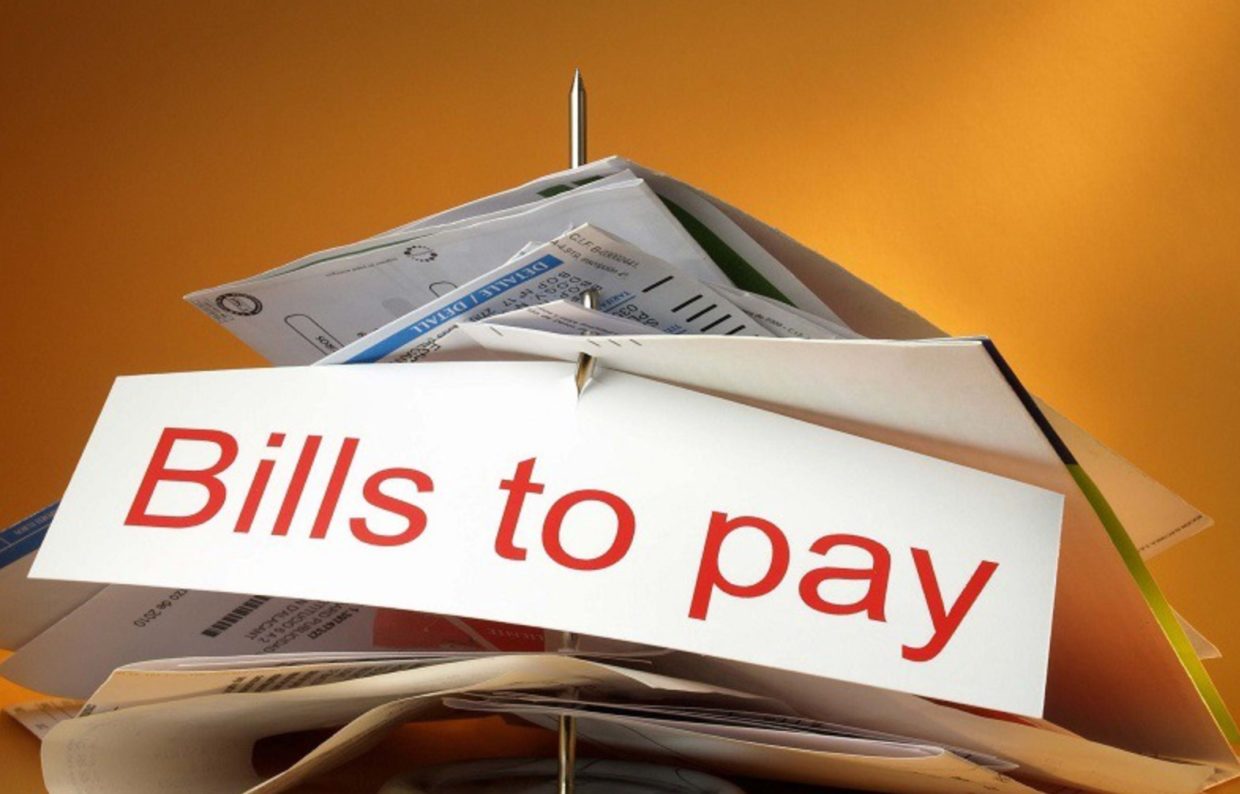

2. Pay Your Bills On Time

That is, by far, one of the most critical steps that you can take to improve your credit score. It is also the easiest way to do it. When you linger in paying your bills, that reflects poorly on your credit score, and obviously, it suffers. No matter how much you try to improve your score, without prompt payments, you will not be able to improve your credit score. That will, in turn, will make your company risky to work with.

3. Decrease Your Credit Utilization Ratio

One of the ways that companies assess your risk is by looking at your credit utilization ratio. That is also called a credit utilization rate. It is always expressed in percentage and tells the companies how much total credit you have available and what amount you are currently using. For example, if you have $10,000 available for use, and you are presently using $5,000, then your credit utilization ratio is 50%. A good credit utilization ratio to maintain is around 15%. If your current credit utilization ratio is more than that, you can lower it quickly.

However, the first thing to do is to pay off your balance. If you cannot pay off the entire amount, make sure that you pay as much as you can so that the credit ratio decreases. Also, you can ask your credit providers to increase your credit limit. As soon as that’s complete, your credit ratio will automatically reduce. When using your credit cards, become as frugal as you can be—it’s a good thing.

4. Establish Credit Accounts With Suppliers

As a business, you must have many suppliers or vendors that you regularly work with. It may be because they have the best rates or the best services. That will mean that you have a great business relationship with them, and you can easily ask them to open a credit account for your business. That will help you by increasing the number of actual payments in your company’s history.

5. Having A Positive Balance

Another thing that is related to your credit account with your vendors is the reporting of your positive payment history. Business reporting agencies do not get the payment data from every supplier and vendor. You will have to do it yourself or ask them to do it on your behalf. Once your business’s payment data is entered into the credit agency database, it will be beneficial for your company.

6. Remove Any Negative Comments or Errors

Another thing that you can do is to start working with reporting agencies and credit card companies to get any mistakes or bad inquiries removed from your files. Make sure that all the data that the companies have on you is up to date and completely accurate. If you see something on your credit report that is not true or something that creates a negative impression, immediately make a call to dispute it. Most companies do not do that and suffer later.

Conclusion

Whenever you want to take a loan or work with vendors or suppliers, your business credit score will come into play. That’s why it is imperative to increase the business credit score by applying the points mentioned above so that your business can survive and thrive.