When clients call the office, they are usually looking for two types of quotes: Liability and very cheap car insurance no deposit. The term “Liability” means the state minimum requirements to drive legally. The legal minimum requirement in most of the states is 15,000/30,000/5,000.

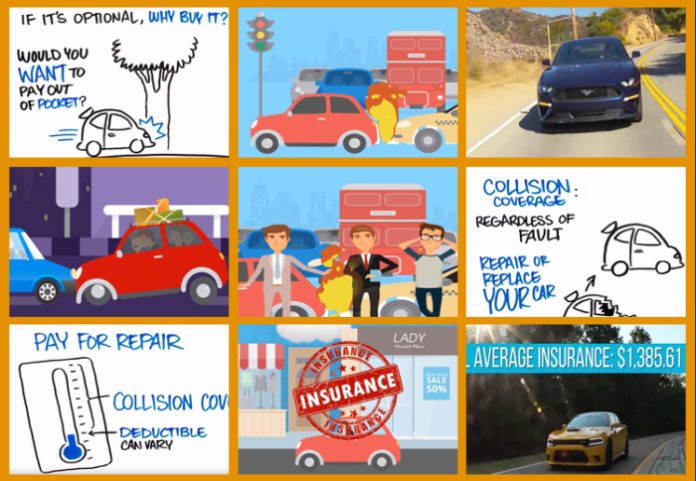

When clients ask for very cheap car insurance no deposit, it usually means they can’t afford adding physical damage coverage to the Liability Limits. Physical Damage Coverage is considered Collision and Comprehensive Coverage.

Understand Your Coverage

Typically, a person who calls for auto insurance does not understand the type of coverage they are asking for. There are clients who had auto insurance for over twenty years and do not understand what they are paying for. Unfortunately, some would find out too late. Usually, after having an accident, they discovered they did not carry enough coverage.

Usually, the answer would be no, when you ask clients if an agent or company representative had explained the coverage to them. The interesting question is how someone could pay for insurance for twenty years and not have an understanding of what they are paying for? It’s like having a car and not knowing how to drive.

You can explain the coverage to clients, and before they even leave the office, they’ve already forgotten. The reason clients cannot comprehend auto coverage is that insurance is technical and abstract. To get the client to understand it, you must use real-life examples and parables. The educational process does not happen at one time. It should be repeated as often as possible.

Bodily Injury

Bodily injury coverage protects you from being sued for bodily injuries caused by you, your family members, or anyone driving your car with your permission. The damages you might be responsible for is pain and suffering, medical bills, and lost wages. Also known as “The Case.”

Most people are familiar with medical bills and maybe paying for lost wages, but what about if the person was self-employed and lost a major contract worth $200,000 because they were hospitalized because of an accident? What about if a person was a Runway Model and was disfigured for life due to an auto accident? What about if the hospital’s stay lasted for seven months because the person was in a comma? What if death occurs as a result of your negligence? How will these individuals and maybe their families be compensated? All of the examples above are covered under Bodily Injury. But would you have enough coverage? The states only require you to carry minimum coverage. These examples need having limits of maybe $100,000 to $300,000 of liability coverage at the minimum.

When you see the term 100/300 on policy, this means that the insurer will pay up to $100,000 if one person was involved in an accident and $300,000 if you are not alone in a crash. For example, if you hit a minivan carrying six passengers, the $300,000 is divided between the six passengers injured in the mini-van, or possibly $50,000 per person.

According to goodtogoinsurance.org, if you have a home, business, or a high income, you should carry as much coverage as you can afford. You can’t apply for instant car insurance with no deposit plan. The problem with many people living in high premium areas is they cannot afford much more than minimum liability limits. By applying some of the strategies outlined in this article, you will be able to lower your rate, thus making it possible to purchase additional coverage.

Property Damage

Property Damage helps cover the repairs or replacement of other cars, trucks, or personal property that you are responsible for damages. Some examples are: your car runs into someone’s house or store, causing $6,000 in damage; you rear in someone and they had a 52” inch TV in the trunk worth $1500, or you run over your neighbor’s fence and expensive landscaping.

Most states only require drivers to carry about $5,000 to $10,000 of property damage coverage. With the price of new cars and SUVs increasing every year, $5,000 of coverage will not cover the cost to fix a brand-new Lexus Sedan.

Property Damage Coverage is less expensive compared to Bodily Injury Coverage. If you drive a large SUV or even a pickup truck, increasing your Property Damage Coverage to a minimum of $25,000 to $50,000 will help cover the cost considering they cause more damage than a small compact car.

Premium Difference in Property Damage Coverage

Property Damage Coverage Annual Cost

- $5,000 $282.00

- $10,000 $361.00

- $25,000 $369.00

- $50,000 $375.00

The difference between $5,000 and $50,000 of Property Damage Coverage is only about $93.00 a year. That’s only about $9.30 a month with a 10-pay plan. Many of us can afford this if the rates are made available.

Medical Payments

Medical Payments is a first party benefit. Medical payment provides medical coverage for you and your family while in a vehicle or as a pedestrian. It also provides coverage for anyone riding as a passenger in your car.

Medical Payments is a “not at fault” benefit. It will pay up to a certain limit per person and occurrence. For example, you apply for very cheap car insurance no deposit, suppose your car was struck in the rear, the car contained dad, mom, son and Cousin Bob. The Medical payment from the auto policy is $5,000.

The benefit would be as follows:

- MOM $5,000

- DAD $5,000

- SON $5,000

- COUSIN BOB 5,000

- TOTAL PAYMENTS $20,000

The Medical Payment Benefits can be used if a vehicle, for example, strikes you or a family member while you are walking. Any family member in your household can use this benefit, even if they were injured in another vehicle than your own.

Another example: your son was riding with his friend Billy. Billy’s dad accidentally hit a tree, and your son was injured. Billy’s dad’s policy would pay whatever costs after exhausting your policy’s medical payments.

If you own a vehicle, it is mandatory that you maintain auto insurance, even if the car is not being used. Some states have encased a law called “No Pay, No Play.” This means that if you are in an auto accident and you do not have auto insurance on the vehicle that is registered to you, you cannot receive or sue for damages or even ask for any benefits because you do not have discount auto insurance quote.

Medical Payments Also Pay for Funeral Services In Addition to Medical Bills

Some of the other treatments are reasonable and necessary medical treatment, rehabilitative services, including but not limited to psychological, surgical, psychiatric, ambulance, chiropractic, licensed physical therapy, dental, osteopathic, nursing services, occupational therapy and vocational rehabilitation, speech audiology and pathology, optometric services, hospital, medication, medical supplies and prosthetic, all without limitation as to time, provided that services are rendered within 18 months.

Medical Payments Annual Cost $ 5,000 $ 587 $ 10,000 $ 763 $ 25,000 $1,016 $ 50,000 $1,174 $100,000 $1,333

With millions of people in the country without health insurance, this is an excellent way to have some medical coverage for you and your family. With companies cutting back on health benefits you do not want to risk being without medical coverage. There are over a million car accidents a year resulting in bodily injuries. Increasing your coverage is the best way of protecting yourself and love ones.

Check your policy, some will give you more time from the date of the accident

Personal Injury Protection (PIP)

More than medical payments are covered in states with PIP. PIP will replace loss wages or pay for loss of services that you would have performed before your injuries from the accident. For example, PIP would pay for someone else to pick up your husband if you were responsible for picking him up from work every day before your injuries.

Income Loss

Income Loss is very similar to having disability insurance inside your auto policy. This benefit will pay up to 80% of the actual gross income, or reasonable expenses incurred for hiring a substitute to perform self-employment duties.

Monthly benefits usually start at $1,000 per month to a maximum of $2,500. The maximum benefit can be as high as $50,000. Instead of waiting for a pain and suffering case to settle, you can collect a monthly income loss benefit. These funds can be used for mortgage payments, car payments, utility bills and other expenses that result from loss of income due to an auto accident. Income Loss benefits are good to have and relatively inexpensive compared to buying your disability insurance.

The cost of individual disability policy for a 35-year-old male with a safe occupation for about $2,000 per month benefit, for a 2-year plan, is about $70 a month. Most disability insurers now require medical examinations. Of course, auto insurers do not need an examination and the benefits are only payable as a result of an auto accident.

Income Loss Cost Per Year

- $ 5,000 $224

- $15,000 $320

- $50,000 $401

The difference between $5,000 and $50,000 of income loss is only $255 a year or $25.50 a month using a 10-pay plan. Would you rather get Income Loss benefits when you first applied for car insurance with no down payment and collect a $2,000 check a month, or wait 15 months for a case to settle?