Invoices are essential for any business owner that wants to get paid the right way. The use of invoices is a must if you want to keep track of your business dealings.

But understanding the elements of an invoice is rather tricky. This is especially the case for first-time business owners who have never filed one before.

Because of that, we’re here to tell you all about the essential elements of an effective invoice. So, don’t go anywhere as we’ll start right now.

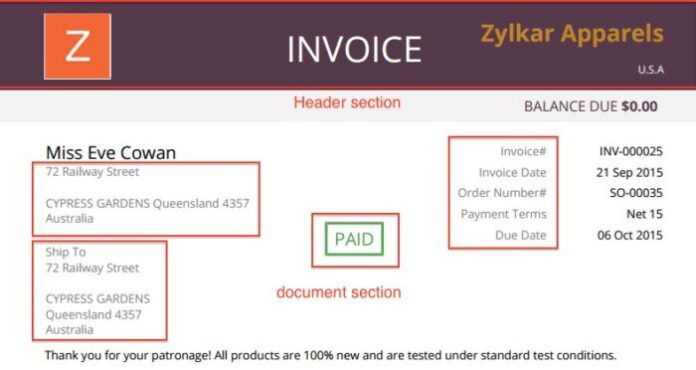

1. A Header With Key Information

Providing this section will save you and the opposing party a lot of time when it comes to managing documents.

An ineffective invoice won’t have this information labeled in the header section. If you truly want to be professional and keep track of every document you sent, then make sure to fill the header with key information.

2. The Number or Unique Identifier of the Document

Much like every ID issued to us, the unique identifier or number is used to identify each invoice. This is crucial information that will make sure you get paid based on the document.

If you fail to provide the unique identifier when sending it, then who knows how effective the document will be.

This number should also be something that will prevent the opposing party from having to contact you regarding key company details. So, this is why it’s a regular practice to specify this unique number identifier as the billing code or purchase order number.

If you want to get paid in a timely manner with little to no headaches, then make sure you do this one the right way.

3. Key Company Information

Every invoice, and we mean every, should contain information such as company name, legal name, address, phone number, and of course, the tax number of your company.

This is done so that the opposing party will have no trouble knowing who they’re paying. This key element also makes sure that keeping things in order is made very easy and very simple.

All you have to do to see who you’re supposed to pay or get paid is to include key company information onto the document itself.

4. The Date Of the Transaction

The date is yet another essential element that can save you from a lot of trouble and headaches. Adding in the date of the transaction is not only proof that the transaction has been made, but proof that will be essential if you choose to take legal matters.

Such problems aren’t unheard of and you’d be surprised the number of people that fail to pay for services and goods.

But confusion is also a huge problem when sending invoices. With this information, however, those confusions are put to rest as there is clear and distinct evidence that the transaction has indeed happened and goods were exchanged.

Always, and we mean always, add the date of the transaction onto the document as it provides so much more in return. If you’re interested in finding out more about this part, and every other part of this article, then you can learn more.

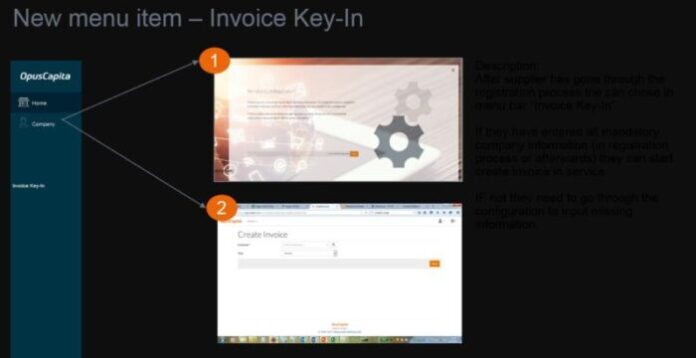

5. The Subject of the Transaction

Ideally, you’d want to include the subject of the transaction itself. For example, if your company sells washing machines and other applications, then your best bet is to include the name of the item sold.

In the case of providing a service, then make sure to add the title of the service.

Other information related to the subject of the transaction includes the price of the item or service, and the quantities sold. For example, if you’re sold three headlight halogen bulbs to a single seller, then make sure to include the name of the unit(s), the price of each individual unit, and the amount sold.

Also, if you’ve sold multiple items or services to a seller, then it would be smart to add each of the prices and give the seller a total.

6. Mention the Fees and Taxes

Opinions are mixed on the subject of where to mention the fees and taxes, but a good practice is to add them into a separate section of your invoice.

This is done so that the buyer has a clear view of what they’re paying in fees and taxes. In an ideal scenario, you’ll put each fee and each tax separately.

But, you’d want this to be done somewhere near the price of the product or service.

A great section would be to label it as “total amount due” and have them mentioned there.

7. Total Amount Due

We just talked about this but failing to provide this element will only make things confusing.

It would be very obvious to include this element, but you’d be surprised by the number of people that don’t actually do it.

Regardless of what you think, you must include the total price the buyer has to pay you. This is quite possibly the only section the buyer is interested in looking at.

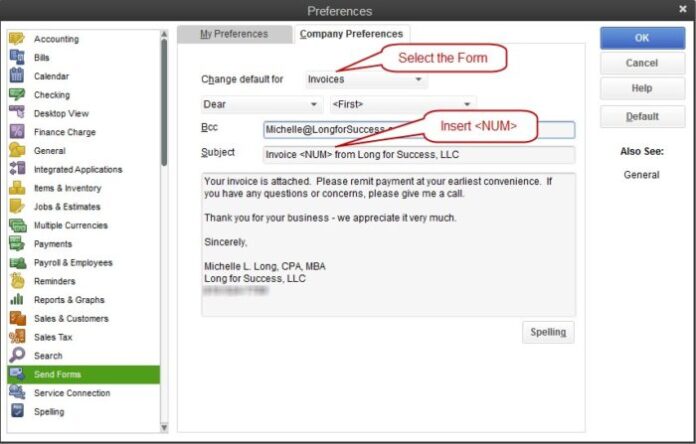

8. Specify the Terms of the Transaction

You’ve probably agreed on certain terms when conducting business with the buyer. If so, then you need to clearly specify them in the invoice.

This will make sure that the buyer understands the terms and is made apparent in an official document for future references. If you’ve agreed on a 12-month rate for the item, then make sure to include that along with the deadline of each month.

Ideally, you’d also want to include any potential fees and penalties the buyer will have to pay if they fail to meet the deadlines or any other terms agreed upon. By the way, understanding the entire procure-to-Pay process can provide valuable context to these invoice details, helping both parties to ensure a smoother transaction and collaboration.

If any of the fees come into play, then the buyer will have to know how much they’ll pay. The fees in question could be late-term fees, flat fees, early termination fees, etc.

In all fairness, there are a lot of things you need to take into account when sending an invoice. This document consists of lots of important elements that you must include if you want to get paid as quickly as possible. While not the least, these were the ones we deemed as essential for any business owner.