Fleet management brings challenges. With vehicles constantly on the road, costs pile up fast. Maintenance, fuel, and driver pay represent major expenses that can spiral out of control if not managed properly. This is why keeping a close eye on fleet expenses is essential for any business with a fleet.

In this guide, we will outline effective ways to track and control your fleet’s expenses. The strategies discussed will help cut costs, streamline operations, and increase profitability.

Key Points:

- Keep fuel costs under control by monitoring usage.

- Implement fleet tracking systems to improve efficiency.

- Invest in preventive maintenance to avoid costly breakdowns.

- Use telematics to monitor driver behavior and vehicle performance.

- Analyze data for better decision-making.

- Track each vehicle’s specific costs for accurate budgeting.

Monitor Fuel Consumption

Fuel costs represent a significant portion of fleet expenses. To reduce fuel waste, it’s essential to track every drop used by each vehicle. Analyzing fuel reports from your fleet tracking system will provide insights into patterns that lead to inefficiencies.

Monitor idle time, routes taken, and fuel stops. This will help you detect problems like drivers taking unnecessary detours or idling too long. Tracking fuel consumption can show where improvements need to be made.

Implement a GPS Fleet Tracking System

A gps fleet tracking system is an invaluable tool for fleet managers. This technology helps control expenses by providing real-time data on vehicle location, driver behavior, and route efficiency.

By installing telematics, you gain visibility of your fleet. Knowing where vehicles are at all times helps reduce wasted mileage. The system records routes, providing a clear picture of daily operations. The insights gained from GPS tracking help optimize routes, cut fuel consumption, and reduce vehicle wear.

Moreover, monitoring driver behavior allows you to identify and correct unsafe driving practices. Hard braking, speeding, or aggressive acceleration increase fuel costs and wear out vehicles faster. With the right data, you can implement corrective measures and incentivize safer driving habits. The result is fewer accidents, less vehicle wear, and lower insurance premiums.

Invest in Preventive Maintenance

Unexpected breakdowns are costly. Labor and parts are expensive, but the downtime hits harder. Preventive maintenance prevents breakdowns before they happen. Regular inspections keep vehicles in top shape, ensuring they remain on the road rather than stuck in the shop.

Oil changes, brake checks, and tire rotations are essential. When done regularly, preventive maintenance extends the life of vehicles and reduces the risk of unexpected breakdowns. This will minimize repair bills and help you control expenses.

By setting up a maintenance schedule, you can ensure each vehicle gets the necessary attention. Routine check-ups, such as monitoring tire pressure and fluid levels, go a long way in reducing costs. Prioritize maintenance before it becomes urgent. You’ll save in the long run.

Track Each Vehicle’s Specific Costs

One mistake that many fleet owners make is lumping all expenses together. To gain better control over your fleet’s finances, track each vehicle’s specific costs. This includes fuel usage, maintenance, and driver wages. By breaking expenses down by vehicle, you can pinpoint which ones are costing more than others.

This data-driven approach provides insight into the health of your fleet. If a particular vehicle constantly requires expensive repairs, it may be time to replace it. Similarly, tracking individual fuel costs per vehicle allows you to see if any vehicles are less fuel-efficient than others.

Analyze Data for Better Decision-Making

Without hard numbers, it’s impossible to see where your money is going. Collecting data from every aspect of your fleet gives you the information needed to reduce costs.

Analyze fuel consumption, maintenance schedules, and driver performance. See which vehicles are costing the most and why. This helps you make informed decisions, such as upgrading inefficient vehicles, adjusting maintenance schedules, or finding better routes.

Having data readily available makes decision-making easier. It also helps with long-term planning by providing insight into patterns and trends. For instance, if certain routes lead to higher fuel consumption, you can avoid them.

Reduce Driver-Related Costs

Drivers represent a significant portion of fleet expenses. Salaries, overtime, and benefits add up quickly. But it’s not just wages that affect your bottom line. Drivers who speed, accelerate too quickly, or brake harshly can drive up costs in more ways than one. They burn more fuel, wear out vehicles faster, and increase the risk of accidents.

By monitoring driver behavior through telematics, you can reduce these costs. Telematics systems track driver habits in real-time, allowing you to address issues as they arise. Some businesses implement reward programs for drivers who maintain safe driving practices, which can reduce accidents and improve overall safety.

Optimize Routes

Time spent on the road directly affects fuel consumption, vehicle wear, and driver wages. The longer your vehicles are out, the more it costs you.

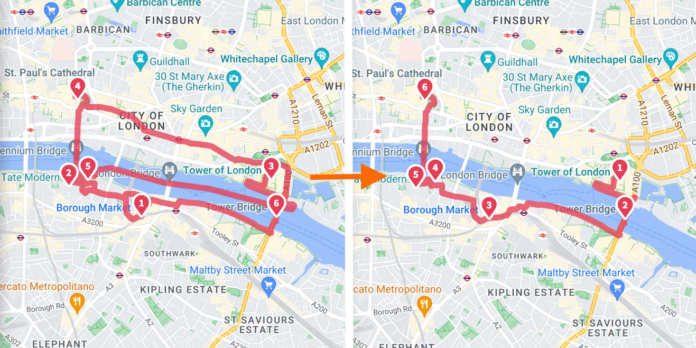

Use GPS tracking and route planning software to find the most efficient routes. This saves both time and money. Drivers can avoid traffic jams, road construction, or areas with heavy congestion. This reduces fuel consumption and minimizes wear on your vehicles.

Route optimization also means fewer stops and more efficient deliveries. The shorter the route, the fewer miles your drivers travel. Over time, this leads to significant cost savings.

Manage Insurance Costs

Insurance is an unavoidable expense for fleet operators. But you can control how much you pay by focusing on safety. Safer fleets cost less to insure. Keeping a good safety record by implementing telematics and driver monitoring will lower premiums.

Some insurance companies offer discounts to fleets that use GPS tracking systems. Monitoring driver behavior and taking proactive steps to ensure safe driving will further reduce insurance costs. Safe drivers are less likely to cause accidents, which lowers the risk and makes your fleet more attractive to insurers.

Additionally, fleets with fewer accidents experience less downtime. Vehicles remain on the road, generating revenue instead of sitting in the shop.

Keep a Budget for Emergency Repairs

Even with preventive maintenance, emergency repairs happen. Budgeting for unexpected repairs ensures your business doesn’t get hit hard when something goes wrong. Set aside a portion of your budget specifically for repairs.

Having an emergency fund in place prevents financial strain when a breakdown occurs. This fund will cover the cost of parts, labor, and any associated downtime. Although breakdowns are inevitable, you can mitigate the financial impact with proper planning.

Conclusion

Fleet expenses can be daunting. But with the right tools and strategies, you can regain control and keep costs in check. From tracking fuel consumption to using GPS fleet tracking, every effort counts. Regular maintenance, optimizing routes, and monitoring driver behavior all contribute to a more efficient fleet.

Keeping accurate data, tracking expenses by vehicle, and having a budget for emergencies ensure your fleet remains cost-effective and profitable. Implementing these practices will put you in a better position to manage expenses and improve your bottom line.