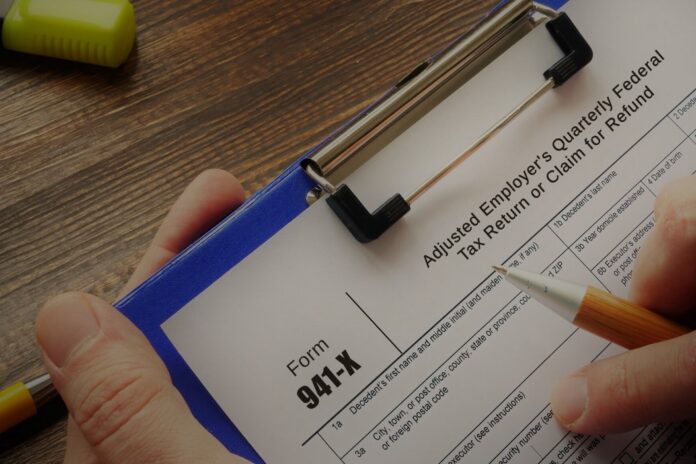

Employers in the United States are required to file Form 941 with the IRS on a quarterly basis to record employee earnings, taxes withheld, and other employment taxes. Despite the ease with which the F941 can be completed, many businesses run into the same issues when attempting to receive their refund. Problems can arise when the form is filed incorrectly, resulting in processing delays, audits, or rejections. Employers must be aware of and prepared to address these widespread problems.

In this piece, we’ll discuss the obstacles that businesses typically encounter when processing an F941 refund and offer concrete advice for overcoming them. Employers can speed up the refund process and avoid penalties or fines if they are aware of these common obstacles and take preventative measures to avoid them.

Problems That Often Occur

Form 941 wasn’t filed correctly

Quarterly, businesses must submit a complete and correct F941 to the IRS. Incorrectly filing Form 941 can cause delays in receiving refunds, interest, and fines, and potentially an audit by the Internal Revenue Service (IRS). Incorrectly reporting employee pay and tips, tax liabilities, and tax deposits are typical errors on Form 941. Form 941 can be rejected or audited if it does not accurately record any taxable compensation or taxes withheld.

Verifying the information on Form 941 for accuracy will help you avoid submitting an incorrect return. To double check their work, businesses might also consult a tax expert. Errors on Form 941 can also be avoided by keeping detailed records and being aware of any updates to tax rules or regulations.

Prolonged processing times

There are many factors that can cause a refund to be delayed, including missing or incorrect information, IRS processing mistakes, or a large number of requests. The IRS allows businesses to verify the progress of their refund online, over the phone, or in the mail. Employers can get information on the status of their reimbursement through the online system, which is also the quickest and most convenient way to verify the status of the refund.

In the event that a refund is delayed, businesses can get in touch with the IRS to learn more about its current status and whether or not any extra documentation is required. An audit or other processing concerns could cause a refund to be held up. The IRS’s Taxpayer Advocate Service (TAS) is a third-party agency that can mediate disputes between taxpayers and the IRS.

Audits and rejections

Failure to deposit or pay taxes, mismatches between reported information and tax returns, and other inconsistencies are some of the most common causes of Form 941 audits and rejections. If an organization wants to prevent audits and rejections, it should double-check Form 941 for accuracy and completeness before submitting it. Keeping up with the most recent changes to tax regulations is another good way to head off any problems.

It’s crucial to get back to the IRS within the specified time frame if your Form 941 is rejected or audited. The audit or rejection letter should prompt the employer to investigate the situation thoroughly and compile any supporting evidence. A prompt and effective response can speed up the problem’s resolution and help you avoid any associated costs.

Businesses can get through the F941 refund procedure with relative ease by ensuring that all required information is included, speeding up the processing time, and successfully reacting to any audits or rejections. Employers can speed up the refund process and avoid potential penalties or fines if they are aware of these typical issues and take preventative actions to avoid them.

Tips to Overcome the Problems While Filing for the F941 Refund

There are a number of methods available for resolving the most frequent issues that arise throughout the F941 refund procedure. Businesses can prevent delays in processing and audits or rejections by taking the necessary precautions when filing Form 941. Now, let’s take a closer look at each of these tactics.

Make sure your Form 941 is filed correctly

The most important thing you can do to avoid headaches with your F941 refund is to fill it out correctly the first time. Before submitting Form 941 to the IRS, businesses can verify its accuracy. Accurate reporting of taxable compensation and taxes taken from employees’ wages is essential, as is reviewing the accuracy of tax payments. If business owner has any doubts regarding the correctness of their tax returns, they should see a specialist.

Reduce waiting time

By checking on the status of their return on a regular basis, businesses can reduce the amount of time it takes to get their money. The IRS allows you to check the status of your return via their website, phone, or mail. If the refund has been delayed, the employer should contact the IRS to find out why. The Taxpayer Advocate Service (TAS) can be beneficial in particular situations. The TAS is an independent group that helps taxpayers work out their problems with the IRS.

Respond quickly and effectively to audits and rejections

There are a number of causes for Form 941 audits and denials. Employers can respond quickly and effectively to audits and rejections by reading the letter carefully, obtaining the appropriate paperwork, and replying by the deadline specified. When replying to the IRS, businesses should give thorough explanations for any differences and submit any relevant documentation.

Common issues throughout the F941 refund process can be overcome by ensuring the accuracy of the Form 941 submission, decreasing the processing time, and promptly responding to audits and rejections. Employers who use these strategies will get their refunds processed more quickly and will avoid any possible financial penalties. Employers can streamline the F941 refund procedure and save unnecessary stress and annoyance by minimizing frequent issues.

Conclusion

In fact, getting a refund after filing an F941 can be a difficult and time-consuming process for businesses. Employers can avoid typical pitfalls by taking preventative measures to guarantee correct Form 941 filing, speed up the processing time, and respond quickly and effectively to audits and rejections. Employers can save time and money by implementing these measures to streamline the refund process and prevent fines and penalties. Understanding the F941 refund process and the typical obstacles can save employers a lot of time and energy. Additional aid is available to businesses who consult experts and use tools like the Taxpayer Advocate Service. Employers can successfully claim their F941 refunds if they take the proper steps.