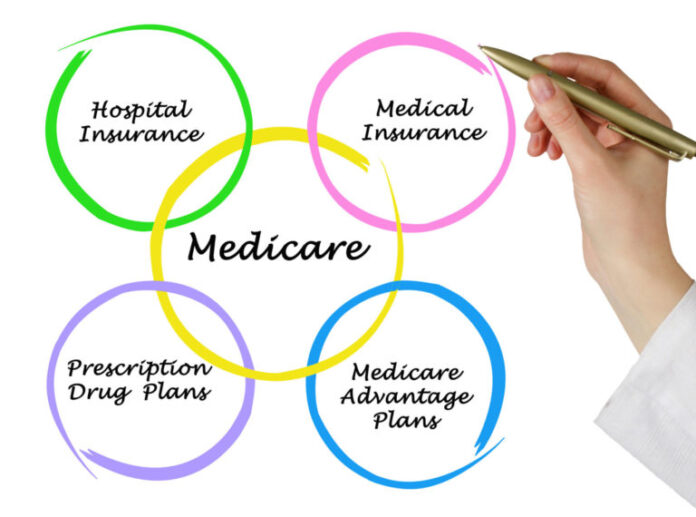

Imagine a situation: you are turning 65 years old and have lived a good life. Your credit score is okay. You’ve got a considerable amount of money in your bank account. Briefly speaking, you are about to retire. So, probably, it’s essential to think about future medical expenses. Citizens and most legal residents of the USA can enroll in a Medicare program. However, it’s essential to understand the key difference between the Original Medicare and Medicare Advantage in order to choose the right plan. Please, keep reading if you would like to know more.

Original Medicare vs. Medicare Advantage: a Few Words About Coverage

Suppose you are about to pay for your Medicare pretty soon. In some cases, it might be extremely difficult to decide what is your preferred plan. When a person wants to determine if they would like to stay on Original or replace it with Medicare Advantage, it’s essential to know the difference in coverage. Here is a brief comparison:

Original Medicare :

- Part A (nursing services, inpatient hospitals)

- Part B (preventative care, outpatient services, doctors’ services, and visits)

- Medicare Advantage:

- Part A (nursing services, inpatient hospitals)

- Part B (preventive care, outpatient services, doctors’ services, and visits)

- Part D for most plans (prescription drugs)

Also, it’s crucial to know that in order to be able to buy a Medicare Advantage plan, you first need to be enrolled in Original Medicare (both Part A and Part B). Medicare Advantage plans usually have prescription drug coverage bundled and they also often cover many other benefits and various offers. For example, a plan you choose might also include multiple hearing services, rides to your physician’s office, dental, vision, and even more. The exact number and names of all additional benefits differ from plan to plan.

Original Medicare vs. Medicare Advantage: a Few Words About Costs

It’s essential to know that everyone must pay standard premiums even for Original Medicare. Part A is free only if you have paid your health taxes for 40 quarters in a row. You still have to pay for part B though. People with very low income can apply to special programs, such as Allstate Medicare Supplement reviews, that help them pay for premiums or other out-of-pocket expenses.

In general, here are all the parts you would probably need to pay deductibles, insurances, coinsurance, premiums, and copays for in Medicare Advantage and Original Medicare packages:

Medicare Original:

- Part A Premium (in case you pay your Medical taxes for 40 quarters and your spouse or you didn’t work)

- Part B Premium

- Coinsurances form part B

- Various deductibles from both parts A and B

- Any additional Part D (including premiums, deductibles, and coinsurances)

Medicare Advantage:

-

- Part B Premium

- Part A low-cost Premium (in some cases even $0)

- General plan deductible

- Various copays for services and medical items

Also, it is essential to know that the Medicare Advantage plan also has a so-called “maximum out of pocket” feature. It helps prevent spending too much money on copays, coinsurances, and deductibles. The out-of-pocket feature can help you keep an eye on all of your Medicare costs and other medical spending.

Original Medicare vs. Medicare Advantage: a Few Words About Providers

It might seem not very important, but one of the main factors when choosing the right Medicare path is knowing which path gives you access to which provider. In case you would like to remain a patient of your pre-Medicare doctor, you should be extra cautious and make sure he or she is authorized to work with Medicare patients.

Also, it’s essential to understand the difference between Original Medicare and Medicare Advantage. Original Medicare covers you in pretty much any hospital in the USA. The primary requirement is that hospitals accept patients who are enrolled in Original Medicare.

With Medicare Advantage, you are restricted to the providers in the plan’s network. There can be some restrictions regarding the hospital’s geographical location and if you visit a doctor or hospital outside of your provider’s network, you will probably need to pay additional costs for all their services. Urgent care and emergencies are covered in all USA healthcare institutions, though.

Original Medicare vs. Medicare Advantage: General Tips

- Think if you will need any additional services. If you would like to get dental, hearing, and vision services, enrolling in Medical Advantage would be better.

- Keep in mind all your approximate and possible medical expenses. For example, your standard monthly payments might be higher with Medicare Original plan. But in some cases, if you suddenly get an acute condition, you might end up with much higher expenses with the Medicare Advantage plan.

- Keep in mind various curiosities and emergencies if you travel a lot. You can get medical care with the Medicare Advanced plan abroad, at least in some cases. Still, it’s better to stick to Medicare Original if you are primarily located in the USA.

Remember that it’s essential to consider the differences between different providers when enrolling in Medicare Advantage. You can read more about both paths in Hella Health or other specialized resources. Remember, the main thing is to understand your unique needs and see what path suits you best.